Become a Patron!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

To Date which US Presidential candidate will you be voting for & why?

- Thread starter SMOKIE

- Start date

- Status

- Not open for further replies.

So, This is really happening:

https://www.congress.gov/bill/115th-congress/house-bill/7207/text

I found it on the Build The Wall link: https://www.gofundme.com/thetrumpWall

So they are actually writing up a bill to get passed with the government spending bill that will not only allow the American citizens to help fund the wall but also the money can only be used for that purpose.

If I had my way, government would be funded in a simular manner since congress has proven to be incapable of managing money.

10% flat tax with the taxpayer writing a check to the agency/dept's that he she wants to fund. The taxpayer can spread the money around but the total must equal 10% or more(the "more" is voluntary) of income. So, if I owe $1,000 I can send $100 to ICE, $500 to DOD, $200 to VA, $200 to hiway dept and ZERO to FDA, FBI, DEA, and etc.

hahahahahahahahaha.....voluntary...your killing me here....the IRS isn't even part of our goverment and they wield more power to destroy someone's life than any law enforcment agency in the country......we have been pulled so far away from the founding vision of our goverment, that I'm not sure if it's restorable...the people look to the state as the supreme beingIf I had my way, government would be funded in a simular manner since congress has proven to be incapable of managing money.

10% flat tax with the taxpayer writing a check to the agency/dept's that he she wants to fund. The taxpayer can spread the money around but the total must equal 10% or more(the "more" is voluntary) of income. So, if I owe $1,000 I can send $100 to ICE, $500 to DOD, $200 to VA, $200 to hiway dept and ZERO to FDA, FBI, DEA, and etc.

If you'd said, "the Federal Reserve" you'd be mostly correct.the IRS isn't even part of our goverment

But the IRS is a bureau of the Department of Treasury, and most certainly is a government agency.

Netanyahu Dissolves Israeli Parliament, Calls For New Elections In Risky Political Gambit

Netanyahu is hoping to expand his coalition's razor-thin one-vote majority in the legislative body to help pass a controversial bill to expand conscription requirements for ultra-orthodox Jews.

Netanyahu is hoping to expand his coalition's razor-thin one-vote majority in the legislative body to help pass a controversial bill to expand conscription requirements for ultra-orthodox Jews.

Spitzer Repeatedly Snuck $5,000/Night Prostitute Into His Apartment Using A Suitcase

"He used to sneak me into his Fifth Avenue apartment in a black suitcase . . . when his wife was away. My knees would be up by my face. When the doorman would ask if he could help, Eliot would say, ‘No, thanks.’ "

"He used to sneak me into his Fifth Avenue apartment in a black suitcase . . . when his wife was away. My knees would be up by my face. When the doorman would ask if he could help, Eliot would say, ‘No, thanks.’ "

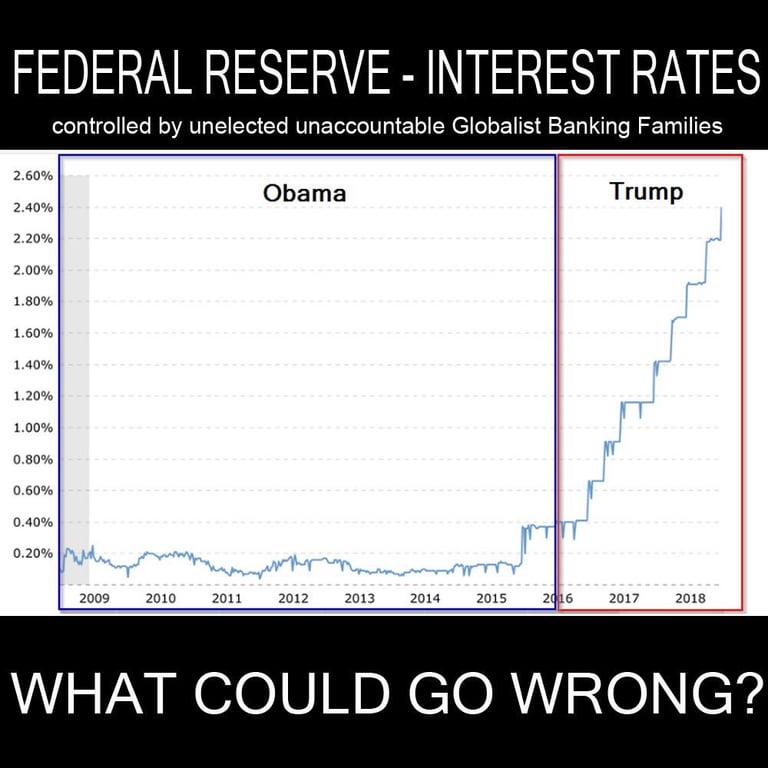

1/2 of 1% for every share or electronic transaction that takes place on Wall St or in financial markets and no private citizen would need to pay any tax.

I'm not sure how you come to that conclusion. All those transactions are made by private citizens.

You greatly overestimate the market participation & frequency of private citizens tranactions. As for those private citizens, I'm sure they would gladly pay 1/2% up front on a trade than 10% after the fact.I'm not sure how you come to that conclusion. All those transactions are made by private citizens.

Meanwhile, The high frequency trading employed by the banking elite, brokerage houses & multinational corporations to manipulate the financial markets would be greatly curtailed if they were forced to pay for the privilege.

You greatly overestimate the market participation & frequency of private citizens tranactions.

Um, any transaction that is not a government transaction is a private citizen transaction. Are you saying that the majority of transactions are government transaction?

As for those private citizens, I'm sure they would gladly pay 1/2% up front on a trade than 10% after the fact.

People are weird so there is no telling what they'd want. But I think most would find out fast enough that when they lose money on a transaction paying a tax on top of the loss isn't ideal. You only pay 10% if you gain on a transaction.

You only lose when you sell(transaction). So if you have to sell in a down market not only would you lose money, now you want them to pay a tax to lose money. Doesn't really make sense when you think about it.

Or at least entities owned by private citizens.I'm not sure how you come to that conclusion. All those transactions are made by private citizens.

Meanwhile, The high frequency trading employed by the banking elite, brokerage houses & multinational corporations to manipulate the financial markets would be greatly curtailed if they were forced to pay for the privilege.

No, they'd just pass the cost of the tax on to the consumer by increased price. They don't pay the tax, you do. And all those are owned by private citizens.

The problem with "High Frequency Trading" isn't the trades that actually execute, and thus would be taxed, but rather the fake bids and offers that are put out there and then retracted milliseconds later. These never execute (so they wouldn't be taxed) but they do apply pressure to ("manipulate") the markets in whatever direction the entities who put them out there desire.You greatly overestimate the market participation & frequency of private citizens tranactions. As for those private citizens, I'm sure they would gladly pay 1/2% up front on a trade than 10% after the fact.

Meanwhile, The high frequency trading employed by the banking elite, brokerage houses & multinational corporations to manipulate the financial markets would be greatly curtailed if they were forced to pay for the privilege.

The fix for the market-manipulation via high-frequency trading lies not in taxation (taxation is theft!) but rather having the markets impose one simple rule: If you put a bid or an offer on the market, you can't retract it in less than two (and preferably 10 or even 15) seconds. This would allow an actual human trader to respond to it.

LOL

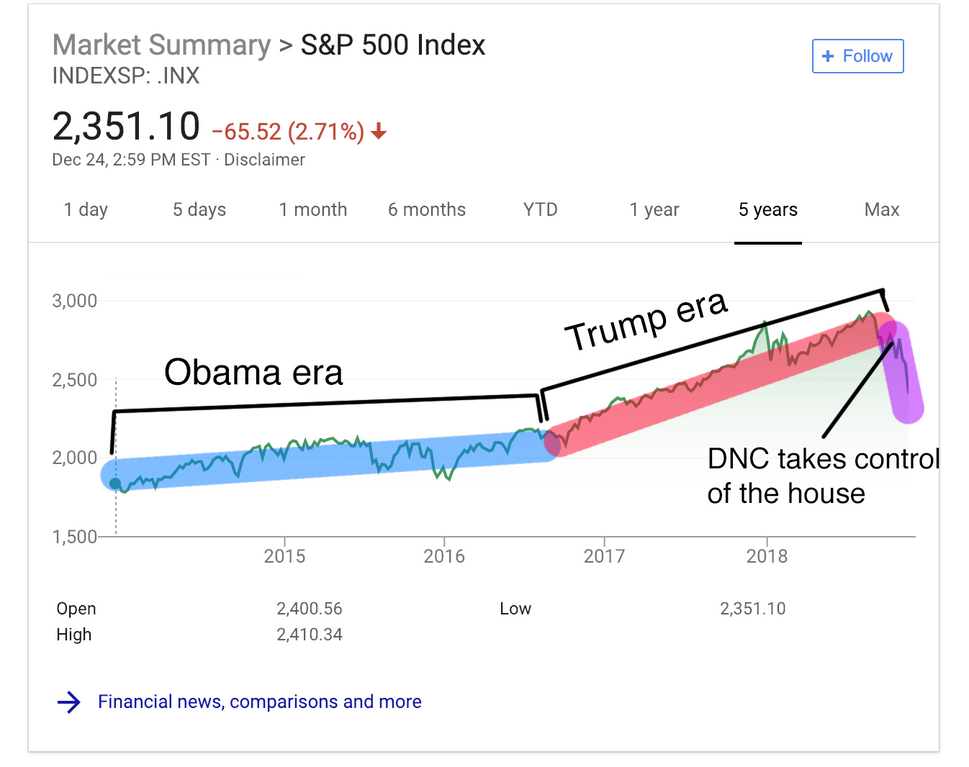

US Regulators Told Mnuchin "Nothing Out Of The Ordinary" In Markets

Top U.S. financial regulators assured Treasury Secretary Steven Mnuchin during a hastily organized call Monday that they are seeing "nothing out of the ordinary" in markets.

US Regulators Told Mnuchin "Nothing Out Of The Ordinary" In Markets

Top U.S. financial regulators assured Treasury Secretary Steven Mnuchin during a hastily organized call Monday that they are seeing "nothing out of the ordinary" in markets.

See I was under the impression they were actually completing the sales from one shell company to another that are merely entities owned or controlled by the same parent company to manipulate the price. By completing multiple small sales from one subsidiary to another they are able to move the prices enough to make it profitable to complete relatively few large scale outside trades that are extremely profitable thereby covering the expense of the large number of small unprofitable trades between subsidiaries necessary to make that happen.The problem with "High Frequency Trading" isn't the trades that actually execute, and thus would be taxed, but rather the fake bids and offers that are put out there and then retracted milliseconds later. These never execute (so they wouldn't be taxed) but they do apply pressure to ("manipulate") the markets in whatever direction the entities who put them out there desire.

The fix for the market-manipulation via high-frequency trading lies not in taxation (taxation is theft!) but rather having the markets impose one simple rule: If you put a bid or an offer on the market, you can't retract it in less than two (and preferably 10 or even 15) seconds. This would allow an actual human trader to respond to it.

My point is the majority of private citizens aren't the ones employing these tactics. Large Brokerage firms are. Paying for the privilege will probably not stop the practice but would raise more than enough revenue to run the government.

Last edited:

PROOF POSITIVE: US Government Has Outright Lied About Chemtrails Since Early 1990s—Undeniable Official Docs!

U.S. Air Force “Chemtrail” Publication and Chemistry Manual Found at a Major University Library

http://stateofthenation2012.com/?p=111496

U.S. Air Force “Chemtrail” Publication and Chemistry Manual Found at a Major University Library

http://stateofthenation2012.com/?p=111496

Yeah we should be happy Trump throws us crumbs...God forbid we hold him accountable for the central plank of his campagin.

Where's Waldo?

How Kevin Spacey vanished off the face of the earth: Shamed star, 59, has not been seen for a YEAR amid claims he's on a Pacific island, in France or wearing disguises

https://www.dailymail.co.uk/news/ar...-not-seen-YEAR.html?__twitter_impression=true

How Kevin Spacey vanished off the face of the earth: Shamed star, 59, has not been seen for a YEAR amid claims he's on a Pacific island, in France or wearing disguises

https://www.dailymail.co.uk/news/ar...-not-seen-YEAR.html?__twitter_impression=true

Was this the false flag Vice Adm. Scott Stearney, commander of U.S. 5th Fleet was suicided over on Dec 1?

URGENT Iranian forces fire missiles at US aircraft carrier in Gulf

https://search4dinar.wordpress.com/...fire-missiles-at-us-aircraft-carrier-in-gulf/

U.S. 5th Fleet Commander Found Dead in Bahrain in Likely Suicide

URGENT Iranian forces fire missiles at US aircraft carrier in Gulf

https://search4dinar.wordpress.com/...fire-missiles-at-us-aircraft-carrier-in-gulf/

U.S. 5th Fleet Commander Found Dead in Bahrain in Likely Suicide

The EU-funded wall that nobody wants to talk about

http://www.iamawake.co/the-eu-funded-wall-that-nobody-wants-to-talk-about-turkey-syria/

http://www.iamawake.co/the-eu-funded-wall-that-nobody-wants-to-talk-about-turkey-syria/

- Status

- Not open for further replies.